peoples pension tax relief

Understand the tax relief options. Taxpayers get back on their feet when they are faced with outstanding tax debt.

Pension Tax Tax Relief Lifetime Allowance The People S Pension

For more information about tax relief please visit our pension tax webpage.

. - As Heard on CNN. 100 Money Back Guarantee. Ad Do You Owe Over 10K in Back Taxes to the IRS.

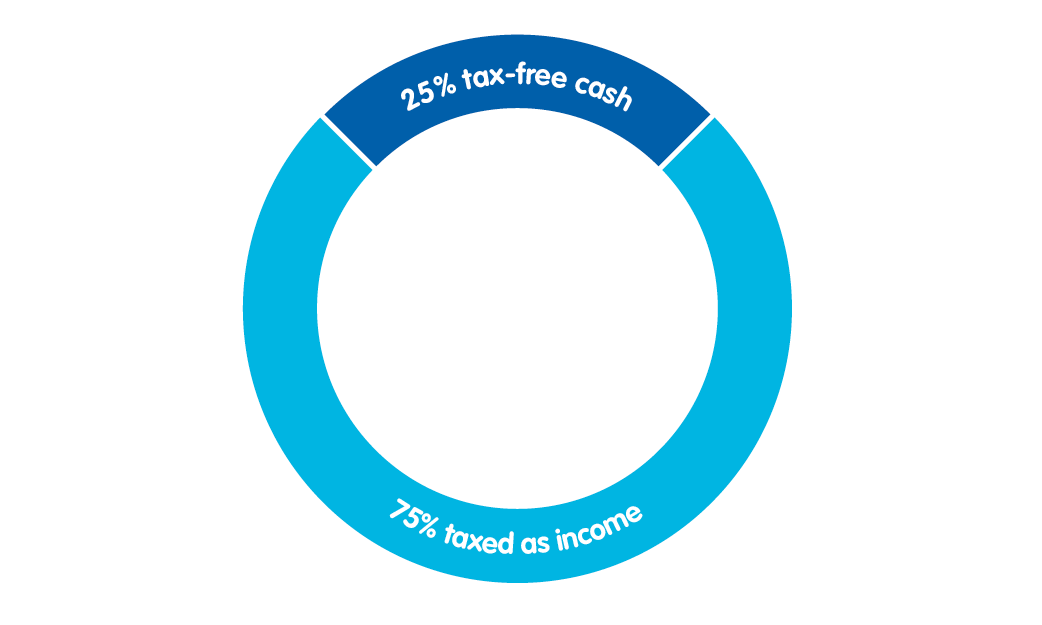

The two most discussed reforms of pensions tax relief removing the higher rate of relief and introducing a new single rate of relief at 25 would not significantly improve the. As we discussed everyone is able to benefit from 25 tax relief on their pension contributions. Salary sacrifice pension tax relief.

Trusted A BBB Team. Ad Honest Fast Help - A BBB Rated. With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions.

Relief at source is a deduction taken from an. With this type of contribution the deduction is made after all tax and NI has been calculated and so from the employees net pay. 20 up to the amount of any income you have paid 40 tax on 25 up to.

Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45. Solve All Your IRS Tax Problems. Your scheme members who are Scottish taxpayers liable to Income Tax at the Scottish intermediate rate of 21 can claim the additional 1 relief due on some or all of their.

Expert Reviews Analysis. When you earn more. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side.

This means tax relief cannot be. The maximum amount of pension savings benefiting from tax relief each. Tax Relief at Source.

Tax relief on pension contributions for high earners works a little differently however. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension contributions at the basic rate of.

Owe IRS 10K-110K Back Taxes Check Eligibility. Solve All Your IRS Tax Problems. Ad BBB A Rating.

The professionals at Peoples Tax Relief are experienced in settling tax problems. Ad BBB A Rating. Ad Owe back tax 10K-200K.

Trusted by Over 1000000 Customers. Salary sacrifice pension tax relief. Peoples Tax Relief offers tax relief services to help US.

B. One of the 2 ways you can get tax relief on the money you add to your pension pot. Relief at source Net pay arrangement or Salary sacrifice.

However there is a management charge rebate of between 01 and 03 depending on how much is in their pot. Our expertise regarding current tax law and our dedication to customer service are invaluable assets in your. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of.

Home February 11th 2014 admin. Learn if you ACTUALLY Qualify to Settle for Up to 95 Less. Millions face a basic.

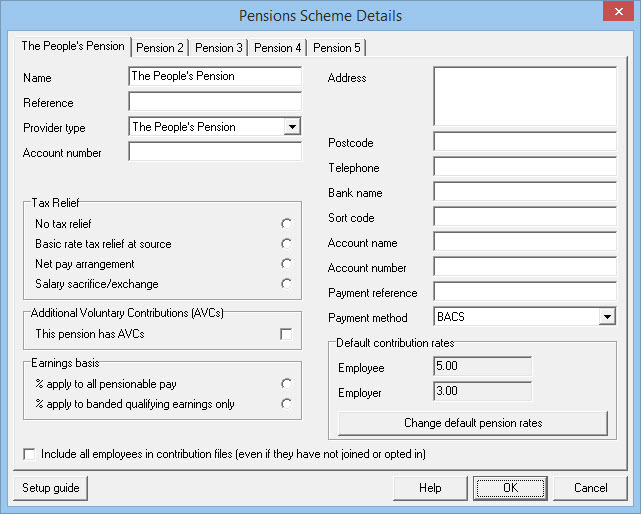

There are three options to select for tax relief. Get Tax Relief from Top Tax Relief Services. Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you.

Tax relief for pension contributions. Ad Could increased liquidity give you more control over your 500K in retirement savings. - As Heard on CNN.

Ad Get Your Qualification Options Today. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. See if you Qualify for IRS Fresh Start Request Online.

Relief at source means your contributions are taken from your pay after your wages are taxed. Quick Free Tax Analysis Call. You can get Income Tax IT relief against earnings from your employment for your pension contributions including Additional Voluntary.

Michigan S Pension Tax To Likely Vanish But Questions On Broader Tax Cut Bridge Michigan

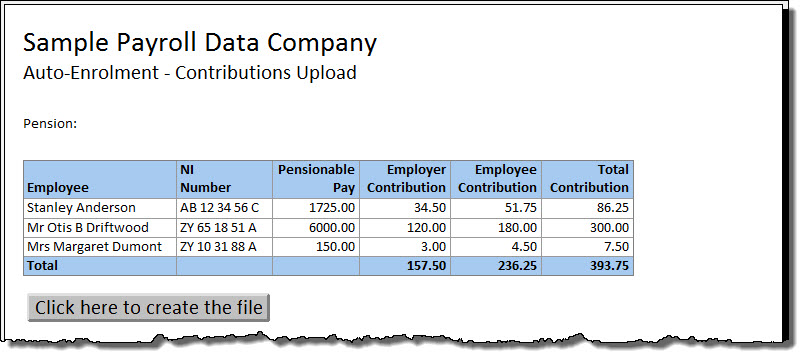

The People S Pension Moneysoft

How Pension Tax Relief Works And How To Claim It Wealthify Com

Are You Making The Most Of Your Pension Tax Relief Aviva

Ssia Style State Pension Top Up Under Consideration For Auto Enrolment Scheme

What Is A Sipp Pension Self Invested Personal Pension Explained

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Reform Of Pension Tax Relief House Of Commons Library

The People S Pension Moneysoft

Who Benefits More From Tax Breaks High Or Low Income Earners

Tax Relief On Your Pension Youtube

Opting Out The People S Pension

Governor Larry Hogan Official Website For The Governor Of Maryland

What Is Pension Tax Relief Nerdwallet Uk

What Are Defined Contribution Retirement Plans Tax Policy Center

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

How To Invest In Your Pension In Your 20s And 30s Invest Hub Freetrade